Indian citizens are fairly familiar with India Publish since their childhood. Investment Savings Bank is the simple choice to help you navigate your banking expertise. Whether you seek effective methods to avoid wasting, handle your transactions, or seek private or industrial lending that can assist you make purchases or travel, the professionals at ISB need to make things simpler for you. Commercial bank loans. Another widespread manner of financing your franchise is thru a standard time period mortgage from a bank. A time period loan is what most people consider when they consider any type of loan financing, particularly if you’ve ever taken out a pupil loan or residence mortgage.

Indian citizens are fairly familiar with India Publish since their childhood. Investment Savings Bank is the simple choice to help you navigate your banking expertise. Whether you seek effective methods to avoid wasting, handle your transactions, or seek private or industrial lending that can assist you make purchases or travel, the professionals at ISB need to make things simpler for you. Commercial bank loans. Another widespread manner of financing your franchise is thru a standard time period mortgage from a bank. A time period loan is what most people consider when they consider any type of loan financing, particularly if you’ve ever taken out a pupil loan or residence mortgage.

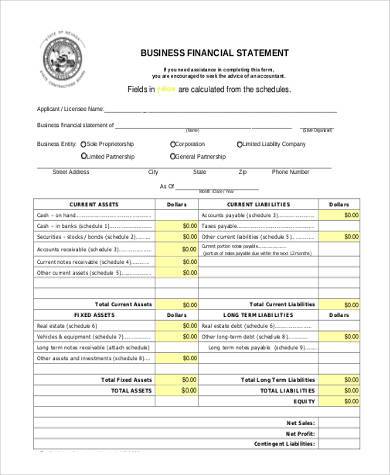

Generally you will also see homeowners’ fairness known as net value. That is computed as Assets – Liabilities = Net Value. While this may increasingly suggest that the business is well worth the amount recorded within the homeowners’ fairness accounts, it doesn’t necessarily mean the enterprise may very well be bought for this amount. Much more needs to be addressed when figuring out the selling worth of a business. Nevertheless, the stability sheet is an important report that indicates how much you have got and how much you owe at a certain cut-off date.

Moreover having basic information of the entrance office and again workplace operations, the Business Analyst should also have good communication skills and nice management abilities to work effectively. As is understood, a Business Analyst is a bridge between the technical team which contains of software program builders and software program engineers, and the end person, which is the shopper of the mission. If the bridge just isn’t nicely-oiled and is rusty and shaky due to lack of knowledge on part of the Enterprise Analyst, the challenge shall fall apart. Therefore the enterprise analyst must guarantee he is updated with the newest developments in the field that he is working in, and the particular necessities of the mission.

In attempting to determine your small business’ financing requirements, remember the fact that you have to have a positive mindset. As the proprietor of the enterprise, you ought to be confident sufficient in your personal enterprise that you’ll be prepared to take a position as much as 10{a3b37e57a53f84d6443a5356ab02984f87900b4dee9193a01d6bf48d204ad87c} of your small enterprise finance needs from your own pocket. The other 30{a3b37e57a53f84d6443a5356ab02984f87900b4dee9193a01d6bf48d204ad87c} of the financing will be from venture capital or other non-public traders. Islamic banks can not rollover loans. Therefore, the packaging and repackaging of loans after which issuing increasingly more debt securities on the again of these non performing loans cannot legally occur in Islamic Banks. look at this site Islamic banks are obliged to have backing of property in all their investments. Therefore, Islamic banks losses even theoretically can not transcend the worth of the actual asset.

The final word aim of any enterprise is to be worthwhile always and earn money; it is cash that helps a business to grow and increase. In an effort to achieve success, a corporation must in a position to manage cash in a sophisticated manner and so all organizations have a finance department that takes care of various monetary transactions. Enterprise finance is the category of enterprise skills that involves managing your organization’s cash. The forms of finance embrace investing, borrowing, lending, budgeting, saving and forecasting.