Regardless of what many may think or say, first impressions do rely and never more so than attending your first interview and especially if that interview is for a place inside an expert organization reminiscent of banking or finance. Worldwide funding banks may advise on the present market tendencies and potential future dangers particularly in the kind of countries, that are at present slightly unstable. To be able to sustain progress and profit, care needs to be taken into the type of investments made. Investing in a properly established safe country has little risk however it might even be too late to reap financial advantages from this space. Many nations depend on exterior traders to help growth enhance in a considerable approach. They provide enterprise alternatives at low prices to the investor who can in their very own way bring extra potential business to this country. By selling development and investment, the chances of profits being garnered from a enterprise can significantly improve.

Regardless of what many may think or say, first impressions do rely and never more so than attending your first interview and especially if that interview is for a place inside an expert organization reminiscent of banking or finance. Worldwide funding banks may advise on the present market tendencies and potential future dangers particularly in the kind of countries, that are at present slightly unstable. To be able to sustain progress and profit, care needs to be taken into the type of investments made. Investing in a properly established safe country has little risk however it might even be too late to reap financial advantages from this space. Many nations depend on exterior traders to help growth enhance in a considerable approach. They provide enterprise alternatives at low prices to the investor who can in their very own way bring extra potential business to this country. By selling development and investment, the chances of profits being garnered from a enterprise can significantly improve.

Funding Banking is a financial service firm or division of a bank that provides advisory services to government, individuals, and corporations in relation to underwriting, capital elevating, merger, and acquisition, and so on. It acts as a bridge between corporations (who want investment to run and grow their business) and investors (who wish to make investments their funds available in the market). Credit score risk management, in finance terms, refers back to the strategy of risk evaluation that is available in an funding. Threat often is available in investing and in the allocation of capital. The dangers have to be assessed so as to derive a sound investment determination. Likewise, the assessment of danger can also be essential in coming up with the position to balance dangers and returns.

“Fairness financing,” in the meantime, is cash a business acquires by selling some of the possession shares within the enterprise. In lots of instances, this can also contain giving up management in some or the entire most important business selections. This is usually a good thing if the investor brings in some distinctive experience or synergy to the relationship. Nevertheless, the terms of an equity funding might be difficult, so it is important to fully understand them and have good legal counsel. listen to this podcast Think of it as a enterprise marriage.

The securities research division evaluations firms and writes reviews about their prospects, often with “purchase”, “maintain”, or “promote” rankings. Investment banks usually have sell-aspect analysts which cowl numerous industries. Their sponsored funds or proprietary buying and selling places of work will even have purchase-side research. Research also covers credit risk , mounted revenue , macroeconomics , and quantitative evaluation , all of which are used internally and externally to advise shoppers; alongside “Fairness”, these may be separate “groups”. The research group(s) usually provide a key service by way of advisory and strategy.

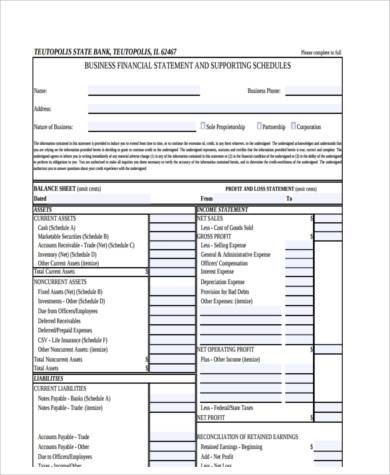

Mar 28, 2020. A business proprietor has to predict whether or not the corporate might be profitable. Budgeting gives a model of the potential monetary performance of a enterprise, given that specific strategies and plans are followed. It supplies a financial framework for making essential decisions. To handle a enterprise successfully, expenditure must be properly controlled. Keep your private funds and your online business funds separate. It’s really easy to confuse the 2 and lose track of how properly your organization is performing. If you’re an organization or restricted legal responsibility firm, it’s legally important to separate your money out of your firm’s cash.